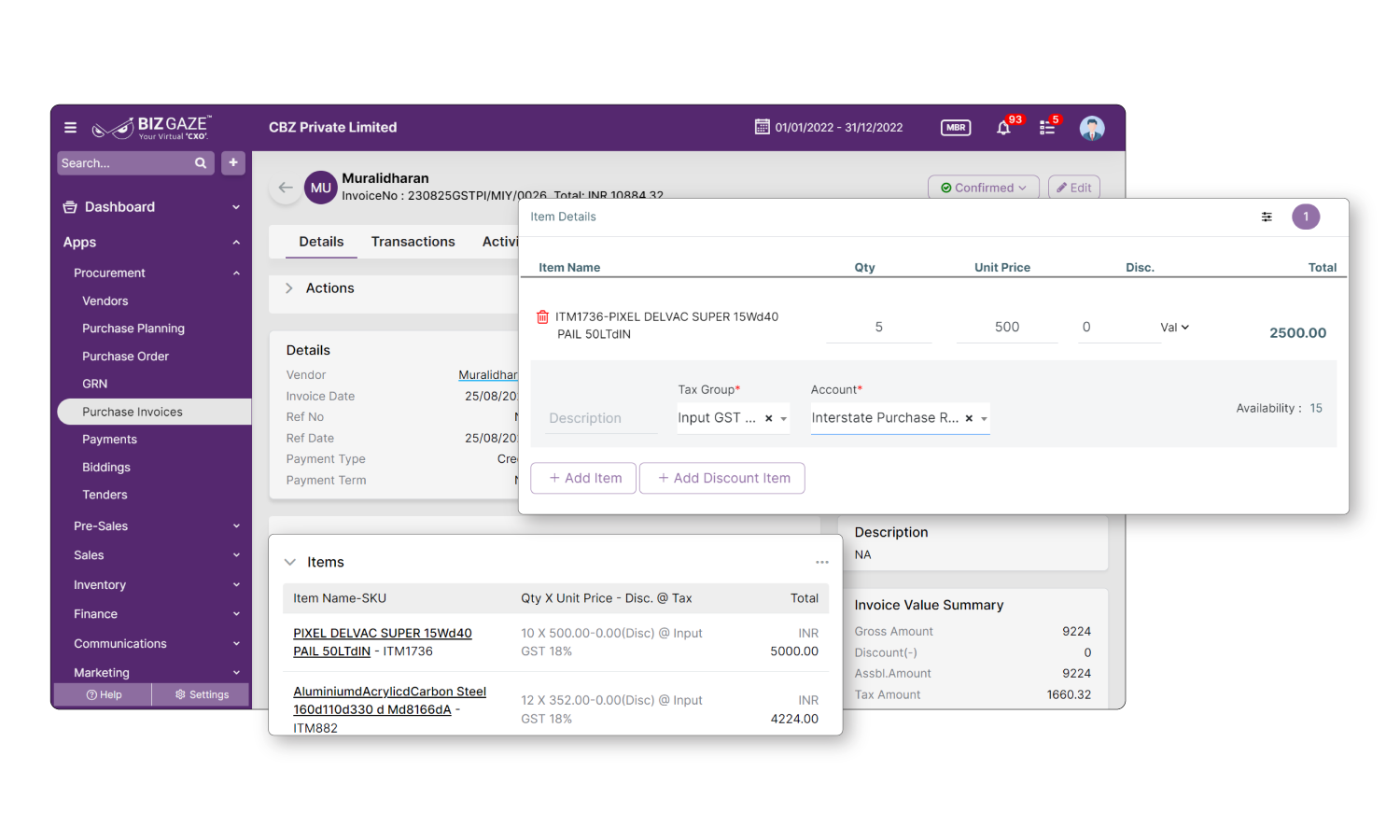

Generate Return for Limited Invoice Quantity

Generate a return for a specific quantity of items on an invoice rather than the entire invoice. Our feature offers flexibility and precision in handling returns, accommodating scenarios where only part of an order requires returning.

Know More

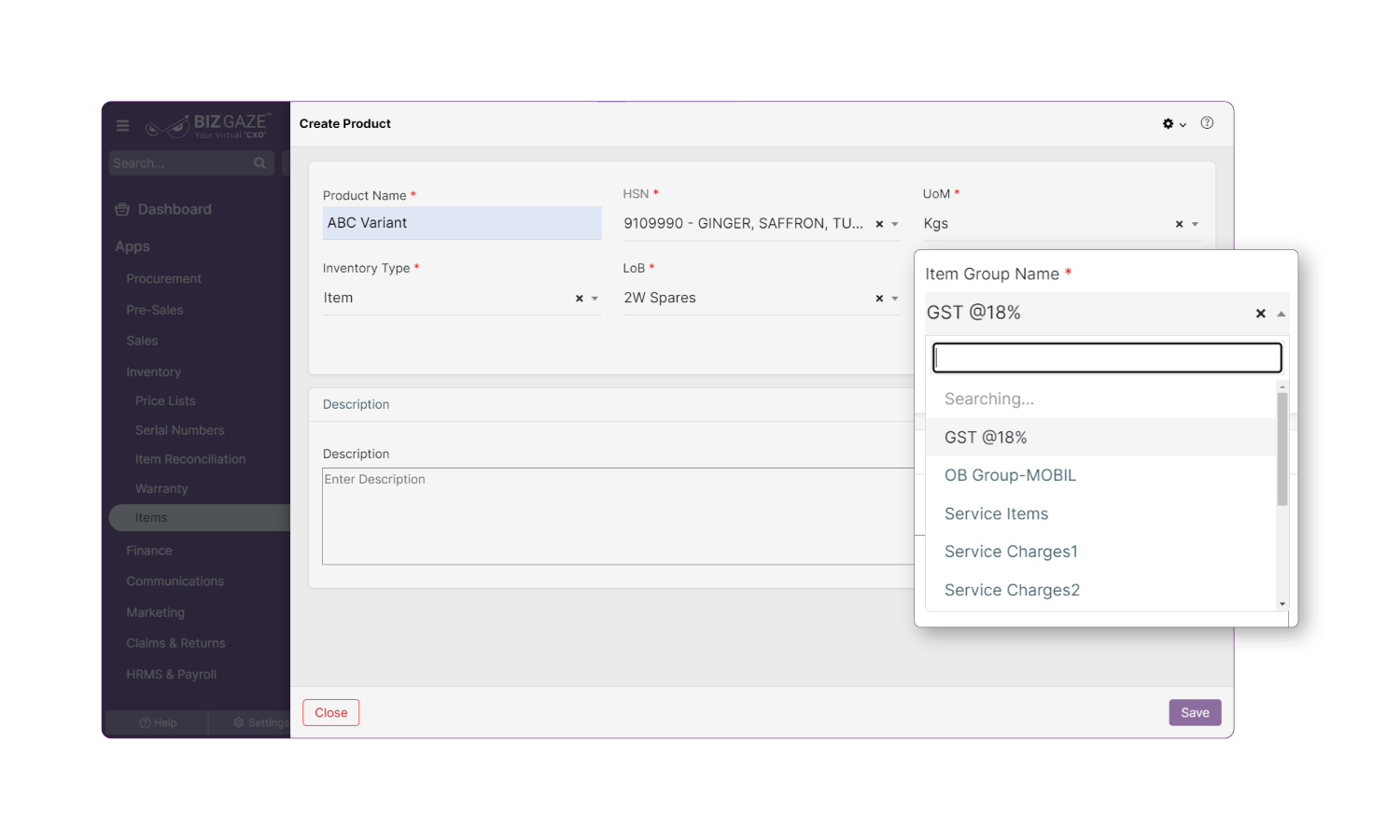

Add Service Item in the Return

This provision allows for including service items within a product return process. Whether related to warranties, maintenance, or other value-added services, this feature acknowledges that returns can involve more than just physical goods, enhancing the efficiency of the return process.

Know More(Make more deals faster)

(Over a dozen reusable features built to provide iconography, dropdowns, input groups, alerts, and much more.)

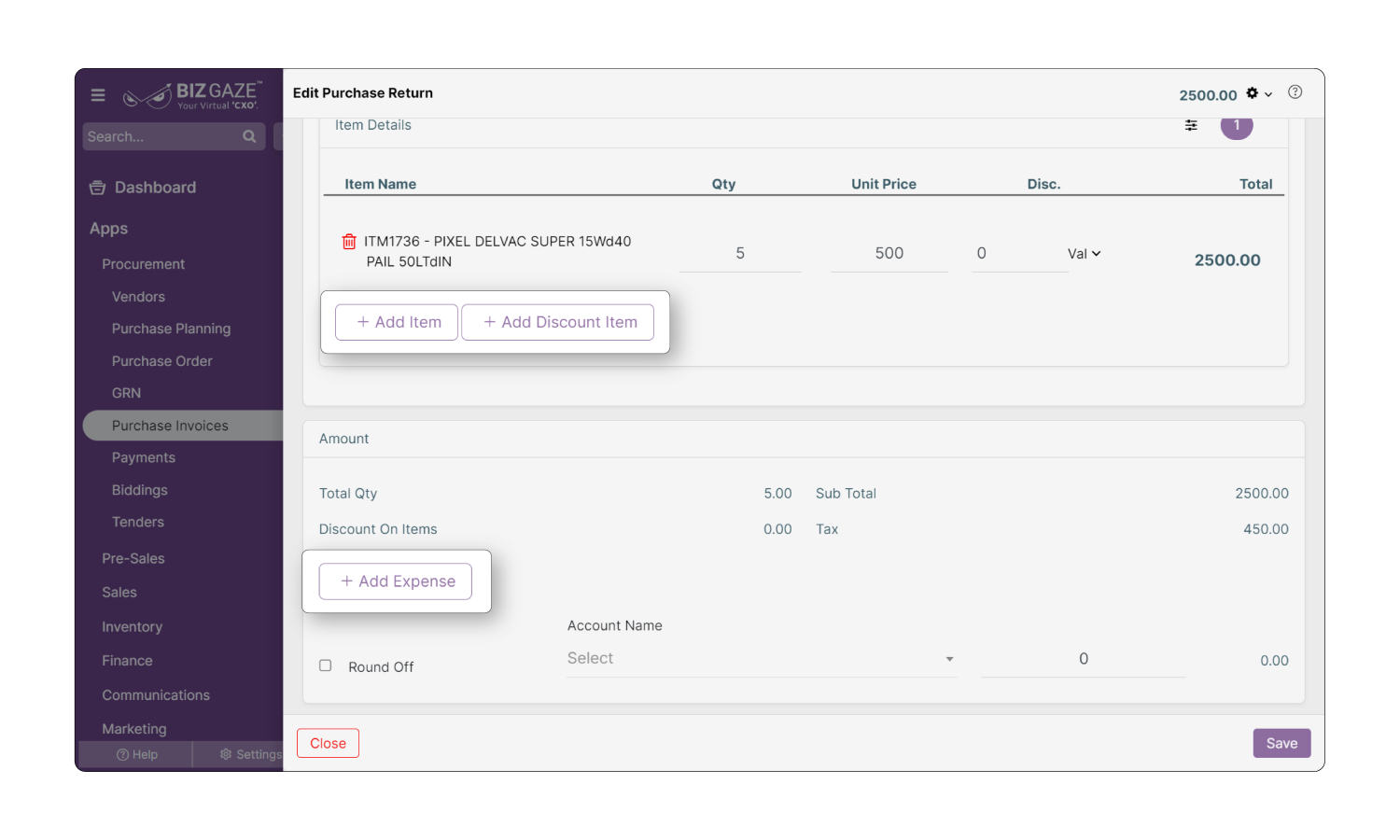

Add After-Tax Discount and Expenses in Return

Returns may involve specific discounts and associated expenses that must be accounted for post-tax. This functionality ensures that all relevant financial aspects are accurately captured in the return process, offering a complete and transparent view of the transaction.

Know More

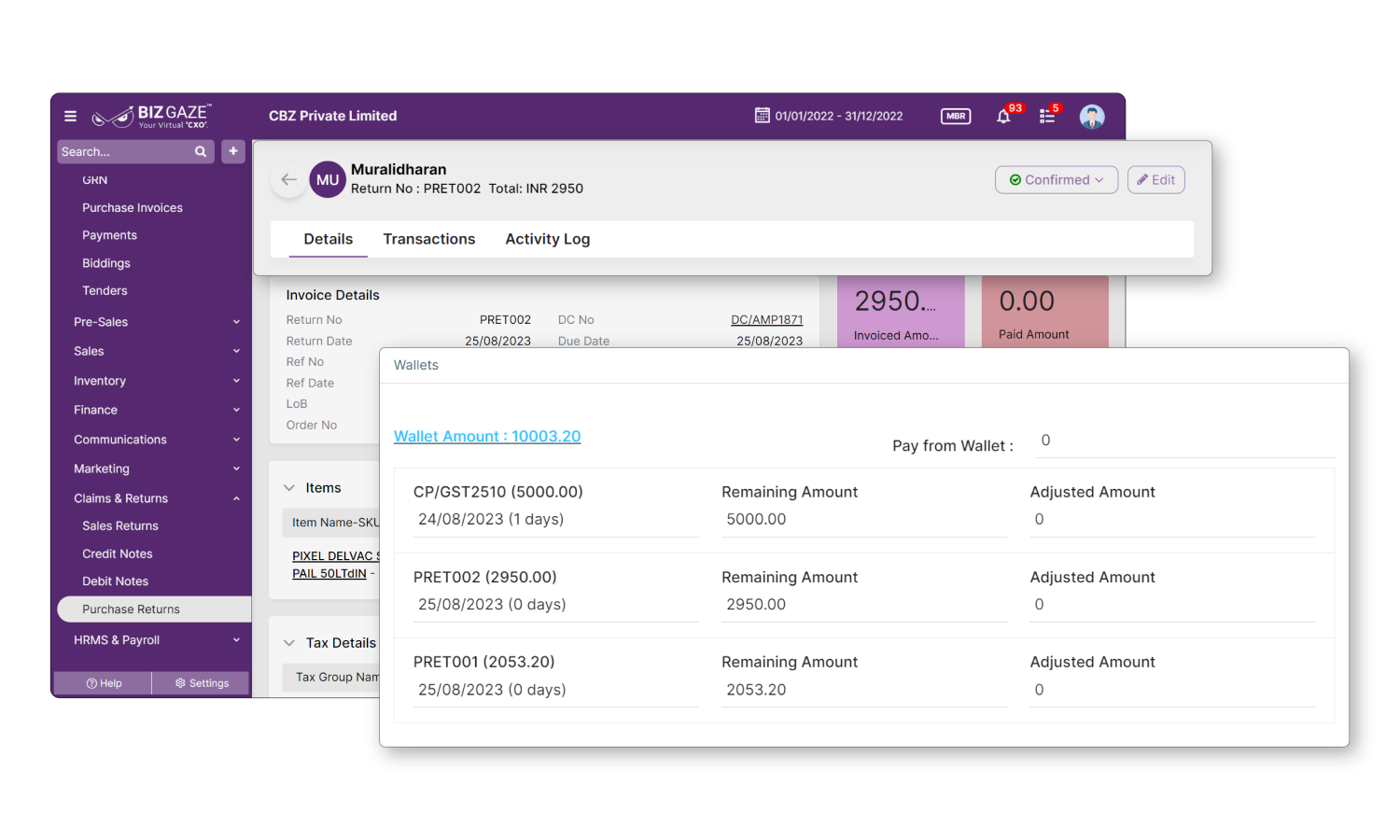

Automatically Generate Debit Notes for Returned Invoices

Our feature streamlines financial management by automatically generating debit notes when an invoice is returned, eliminating manual effort and potential errors. Integrating this automation can give a clear and immediate understanding of the financial adjustments related to the return.

Know More

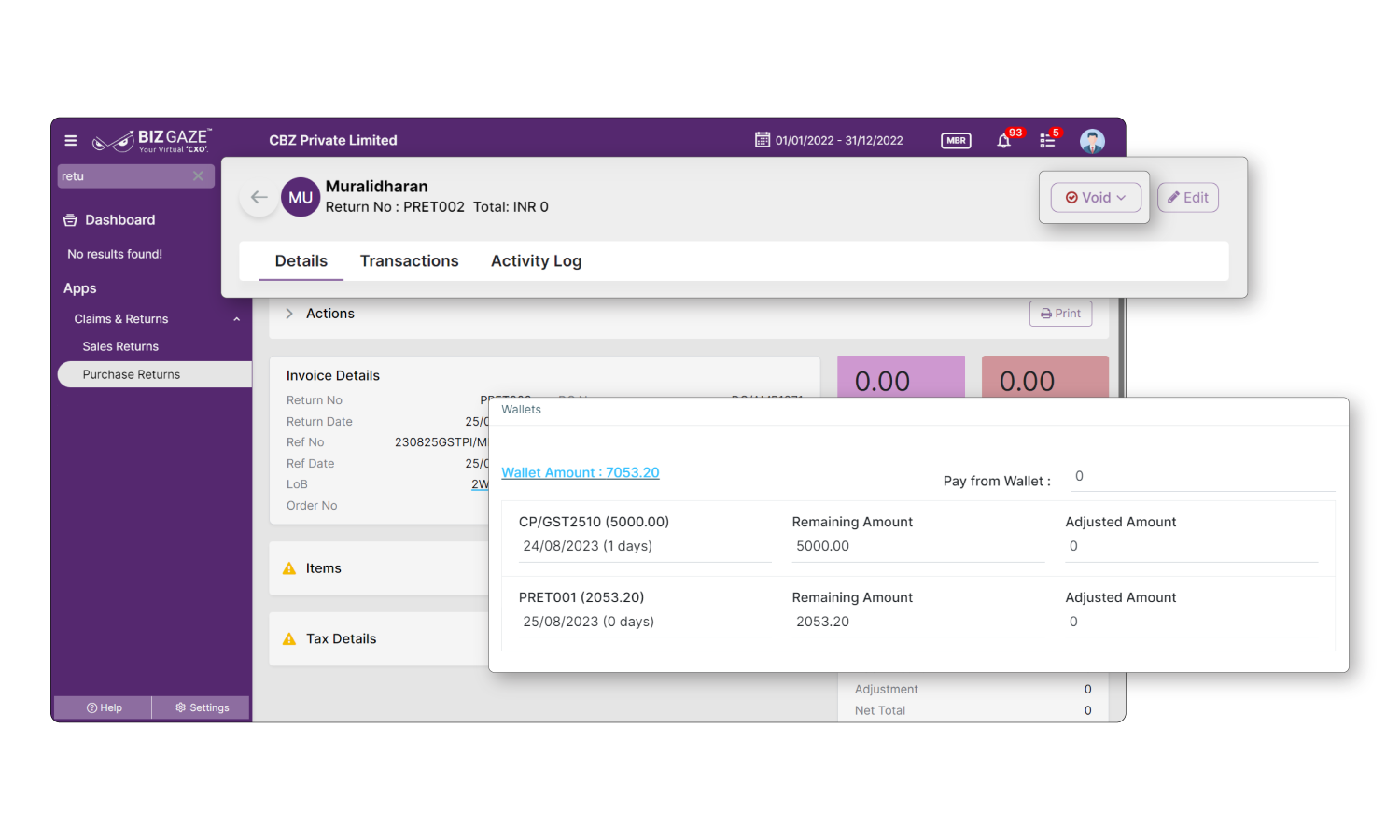

Void Returns and Auto-Delete Debit Notes

This provision introduces a seamless way to void returns and automatically delete associated debit notes. If a return is canceled or deemed unnecessary, the system will void the return and take care of the linked debit note, ensuring that financial records remain accurate and uncluttered.

Know More

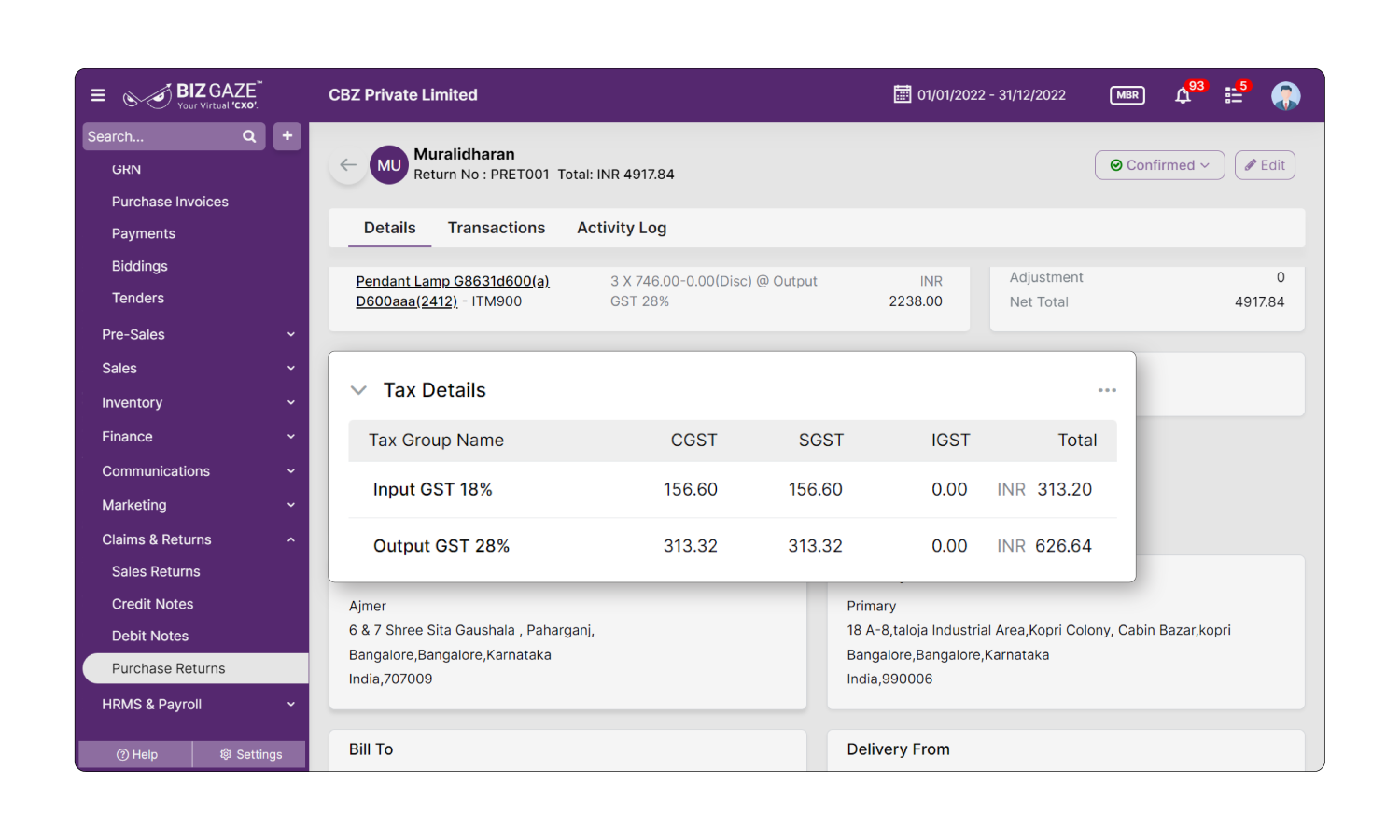

Gain Insights into Tax Details

Regular tax management or periodic auditing, this feature is a valuable tool for financial professionals and business leaders, offering a comprehensive view of all tax-related information within your business operations. Get a clear and detailed picture from tax rates and categories to specific transaction details.

Know More